These discussions focused on the importance of the poultry industry within the economy, as it is a large supplier of jobs, the largest user of local maize and certainly the cornerstone of the local soya bean industry, to name but a few. The challenges faced during the last 2 years started with very high maize and soya bean prices, which came on the back of the most severe drought in many years, followed by a steep increase in the dumping of chickens onto the South African market and then the latest blow, avian influenza.

Apart from the welcomed relief on feed prices, there was a considerable drop in the dumping of chicken. Although chicken imports were still at high levels, there was a positive sentiment throughout the industry. Photo: Matee Nuserm / Shutterstock

A drop in dumping figures

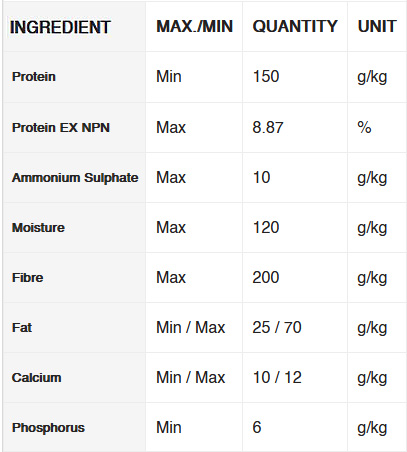

Good rains in the maize and soya bean producing areas saw a turn-around from severe drought conditions to the largest grain crop yield recorded in our history. This gave way to maize and soya bean prices plummeting to low levels, which can be expected to remain low for some time. Apart from the welcomed relief on feed prices, we also experienced a considerable drop in the dumping of chicken. Although chicken imports were still at high levels, there was a positive sentiment throughout the industry. However, shock waves went through the poultry industry with the first avian influenza (AI) outbreak during the early winter months. The calculated impact of AI on the poultry industry up until the end of September 2017, is illustrated in Table 1.

Losses per province

The latest AI-related losses (approximately 200,000 layers) were reported at the beginning of October 2017, and we can safely expect to be AI-incident free until the coming winter, when the risk will increase again.

- Mostly older birds were affected, and calculations were made as though all the losses occurred halfway through the production cycle (layers and broiler breeders).

- A normal replacement programme will see a full recovery in numbers by September 2018.

- Feed lost through commercial layers was taken at 20kg/bird lost.

- Feed lost through broiler breeders was taken at 27kg/bird lost.

- Broiler breeders lost are also responsible for a loss in broiler numbers, calculated as 60 broilers per breeder lost = 21,624,000 broilers.

The feed volume lost due to AI represents the volumes of almost two average size feed mills, and a further drop of 2.5% in feed sales from AFMA members could be expected, this on the back of AFMA feed sales already dropping by 6.25% for the 2016/17 financial year.

This article has been published first in the AFMA Matrix.

Source: AllAboutFeed